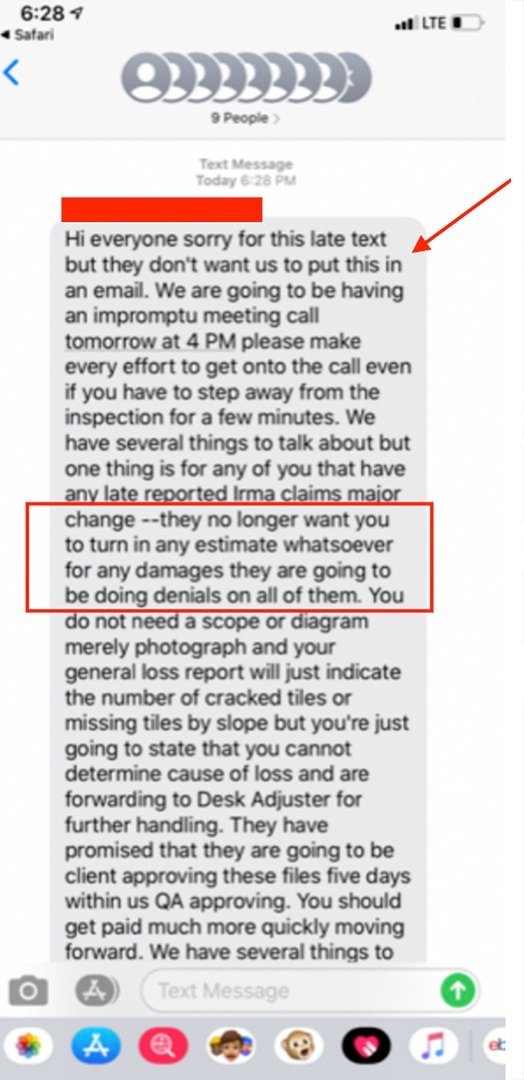

“They no longer want you to turn in any estimate whatsoever for any damages they are going to be doing denials on all of them.”

This is a message sent by an FKS Adjuster Manager telling her field adjusters to stop turning in estimates because the claims they were handling were going to be denied no matter what. Funny enough, this message was put in a text message, but the manager indicated her bosses did not want this message going out in an email. This was most likely due to the fraudulent nature of the message. They probably didn’t like to see the directives they were forcing these adjusters to abide by going out in a text message either.

In the image above, the manager tells every field adjuster in the text message chain, which includes nine people, to stop turning in estimates because they will be denied. She goes on to tell the field adjusters they “should get paid much more quickly moving forward” as a result of this new implementation for denying claims.

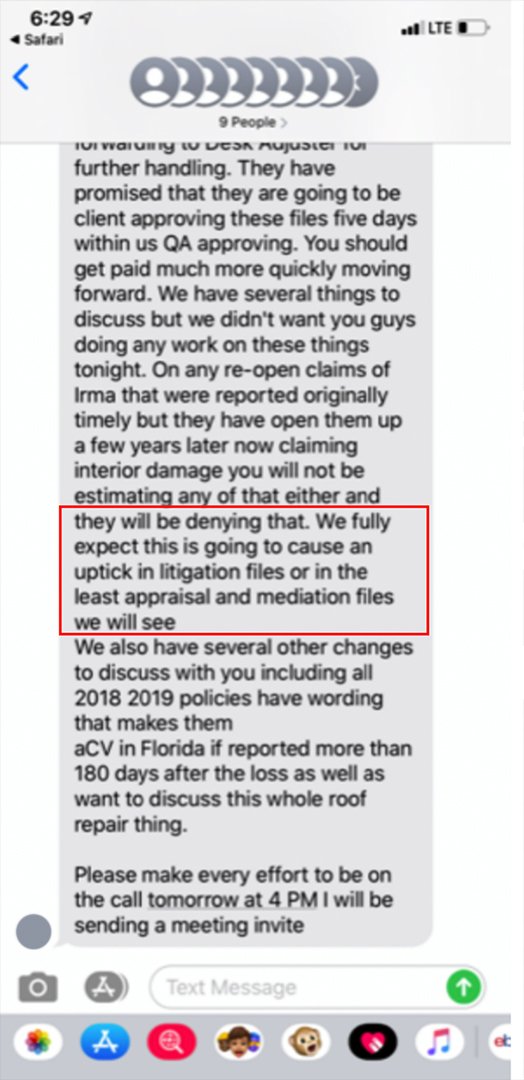

“We fully expect this is going to cause an uptick in litigation…”

The FKS Adjuster Manager wrote those words in addition to her previous comments when she stated any future claims would be denied. Insurance companies know exactly what they’re doing, yet they continue to place more importance on profits than on fulfilling their duty and honoring the policies they have issued. If they know their actions will lead to an increase in litigation cases, then they obviously have to understand they are the culprits in this situation.

Insurance companies should not be giving out directives instructing field adjusters on what they can and cannot include in their reports.

Many employees working for insurance companies have a role to play to keep the wheel of deceit and fraud spinning. The manager, in this case, played her part. If she didn’t give those directives to the field adjusters, we can only infer that someone else would have. It also seems the manager had her own set of directives that she had to follow. She used the words “They no longer want you…” indicating others are involved in the decision to deny all upcoming claims. Meaning the decision was made by upper-level managers or even leadership from the insurance company, and the orders continued to trickle down until they reached the field adjusters. FKS one of the major adjusting firms for many of Florida’s insurance providers. FKS would provide field adjusters to work on thousands of claims in the state of Florida.

“You cannot determine cause of loss and are forwarding to Desk Adjuster for further handling”

Telling field adjusters to say, “you cannot determine cause of loss and are forwarding to Desk Adjuster for further handling” is not ethical, but it’s how they will push the sequence of denial through. Every action taken is carefully thought out to help ensure the insurance company can deny every claim they want to.

What is a Late Reported Irma Claim?

The manager references “late reported” Hurricane Irma claims but what does this mean? In these circumstances the phrase “late reported” is a term of art crafted by the insurance companies. At the time of Hurricane Irma insureds had three (3) years to report, reopen or supplement a claim. Additionally, they had 5 years to file a lawsuit against an insurance provider for Hurricane Irma claims. Throughout the course of litigating many cases Attorney John Tolley has discovered that these claims the adjuster is referencing were reported well within the three years allotted by Florida law.

What can you do about cases involving insurance fraud?

Only about 1 in 20 insured homes file a claim each year, out of which thousands of policies are denied, underpaid, or delayed each year. The shocking truth is right in front of us. Insurance companies are not in the business of helping people. They pay when they have to, but if they can avoid paying you, they will. Attorney John Tolley from JT Law Firm is constantly facing off with insurance companies – in and out of the courtroom. As a result, he is constantly deposing the insurance companies’ field adjusters, and shocking truths are uncovered during these depositions.

Just because the insurance company denied or underpaid you for your claim does not mean the process ends there. Speaking with an attorney can turn the tides in your favor. Our team of property insurance claim attorneys know how to fight the insurance companies, and they have a track record of delivering maximum compensation.

There is no upfront cost to get started, and you only pay if we win.

Schedule your free case evaluation today.

Call us at 855-585-2997!